Britain's Fiscal Reckoning: The Inevitability of Spending Cuts

Deep and significant spending cuts are inevitable in the UK. Politicians who say otherwise are either blind to reality or lying.

This week, the National Institute of Economic and Social Research (NIESR) became the latest institute to attempt to deliver a wake-up call to the Government about the UK’s dire fiscal situation, warning that Chancellor Rachel Reeves faces an "impossible trilemma" as she attempts to square the circle between her fiscal rules, Government spending commitments, manifesto promises not to raise taxes on working people, and most significantly, a large contingent of Labour MPs who will oppose any form of spending cut in Parliament.

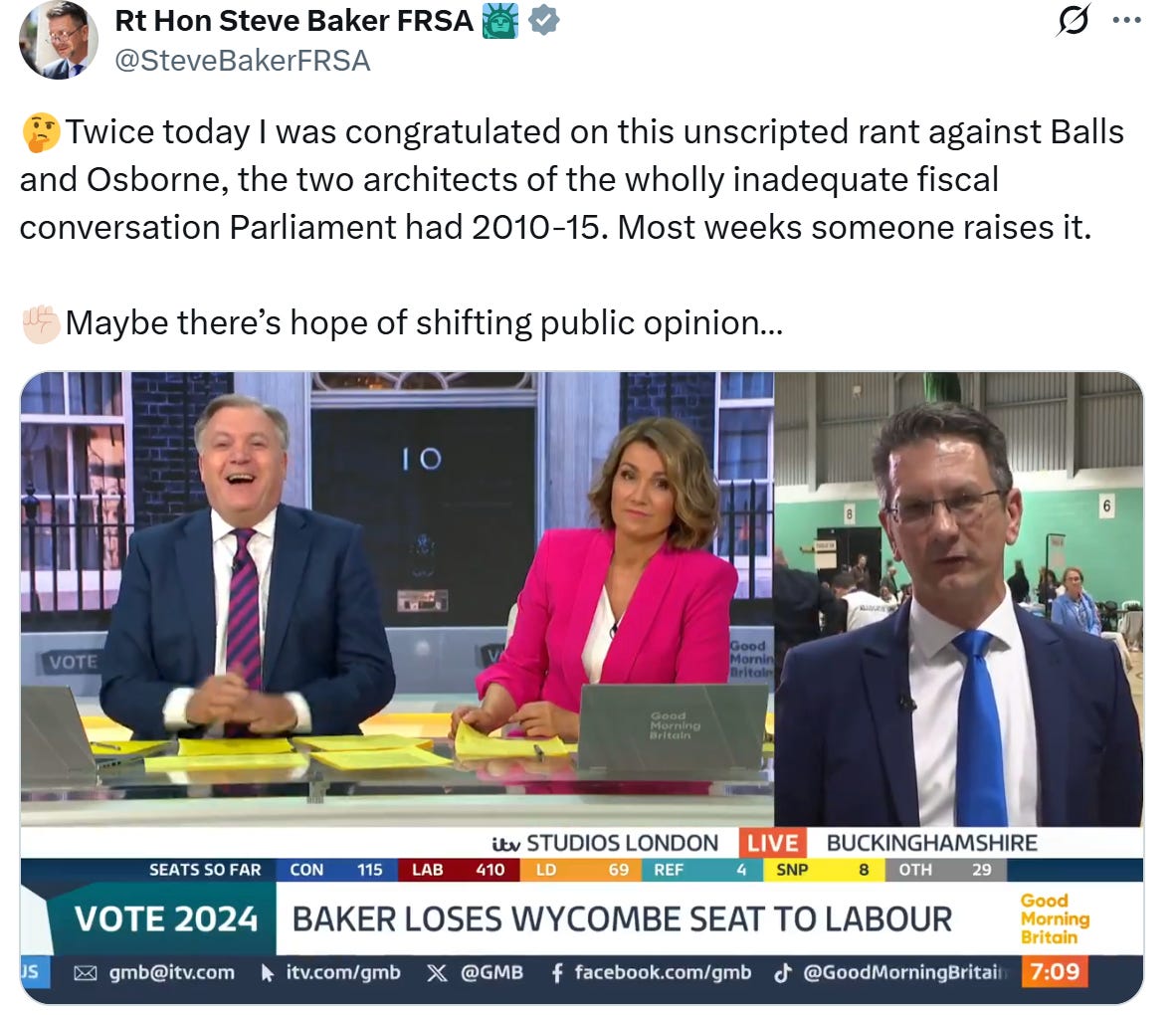

It was almost prophetic when the Chair of Fighting for a Free Future, the Rt Hon Steve Baker, said to George Osborne and Ed Balls on the morning after the General Election:

Rachel Reeves is going to find that she has to do austerity, and she is going to have to do austerity with these Labour MPs who said it was a choice. It is going to be a circus.

As the debacle over the Universal Credit and Personal Independence Payment Bill shows, I think we can all agree that the circus has come to town: it’s now named the Universal Credit Bill after all of the savings from cutting and reforming PIP were removed in the face of Labour Party rebellions.

With a projected £41.2 billion shortfall by 2029-30, the NIESR estimates that Reeves will need to find over £50 billion through tax rises or spending cuts just to restore fiscal credibility.1

Yet once again, the media coverage has predictably focused on the need for tax rises rather than the obvious alternative: drastic spending cuts. Headlines across the board have parroted the same tired refrain - that Britain must raise taxes to "fill the black hole" in public finances. The Independent declares that the Chancellor must "raise taxes to plug £50bn black hole", while the BBC asks "What economic levers are left for Reeves to pull?" - as if the only lever available involves extracting more money from an already overtaxed population.2

This relentless focus on tax increases rather than spending reductions demonstrates the fundamental misunderstanding that pervades British political discourse: that the state has a divine right to spend ever-increasing amounts of other people's money, and that any shortfall can be met by further taxation rather than countenancing living within our means.

We are at the Limits of Taxable Capacity

What the cheerleaders for higher taxation fail to grasp is that Britain has already reached - and arguably exceeded - the upper limits of sustainable taxation. David B. Smith's 2020 analysis for Politeia, "Britain's Taxable Capacity: Has it Reached the Upper Limit?", provides evidence that the UK is operating at the very edge of fiscal sustainability.3