Budget 2025: Labour is doing the worst kind of austerity

Austerity is the bill that arrives after years of fiscal mismanagement. It is not a moral choice but a consequence.

In case you missed it, Rt Hon Steve Baker FRSA will be hosting a live Question and Answer session here on Voices for a Free Future for paid subscribers in two weeks, 18:30 GMT on Thursday the 4th of December. Find out how to submit a question here.

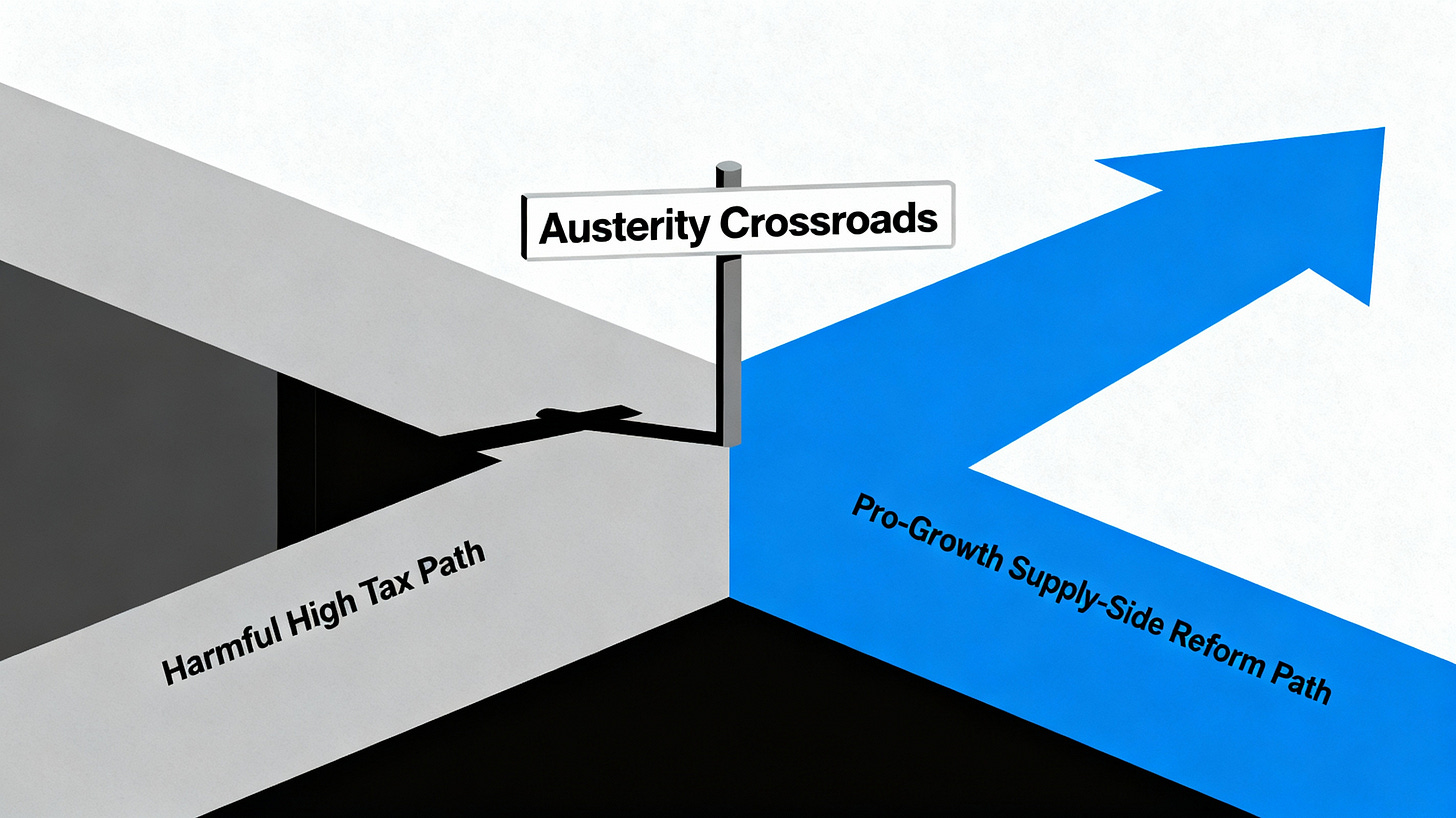

Austerity has become a political taboo. Rather than an economic term to be analysed, it is now an insult used to discredit opponents. Yet the uncomfortable truth is that austerity is not really a choice for a country that isn’t growing. It appears in two forms: spending cuts or tax rises. And, as Ben Ramanauskas argued earlier, tax rises are a form of austerity, often the most damaging kind because they suppress the very activity required for recovery.

But what is austerity, really? At its simplest, it is an attempt to reduce government deficits and stabilise public debt through spending cuts, tax increases, or a mixture of the two. If governments maintained balanced budgets, kept inflation under control, and avoided excessive borrowing in the first place, there would be no need for austerity at all. When critics demonise it, they ignore the first principle: austerity is the bill that arrives after years of fiscal mismanagement. It is not a moral choice but a consequence.

Despite this, the political backlash against austerity remains enormous. Rachel Reeves referenced the term four times in her recent speech, insisting repeatedly that Labour would “not return to austerity.” Yet her policies amount to the worst kind of austerity we could have: historically high tax burdens and no credible plan for restoring growth. Even Keynes - so often used as a shield for higher spending - would be unimpressed. His view was clear: “The boom, not the slump, is the right time for austerity at the Treasury.”1 But for the past two decades, British governments of all colours have defaulted to higher spending regardless of where the country sits in the economic cycle.

So what must be done to restore growth? The left insists that austerity is never the answer and that government must stimulate demand even further. But as Deirdre McCloskey once said, modern Keynesianism often forgets that economies also have a supply side. Reeves’s programme demonstrates the same blind spot: supply-side reforms are delayed, downplayed, or treated with suspicion.

A credible growth strategy must begin with a good theory of growth. And the government’s theory isn’t working, because it rests on a profound misunderstanding of how prosperity emerges. Real growth comes from microeconomic foundations. It comes from individuals and firms experimenting, innovating, discovering new opportunities, and adapting to changing conditions. It does not come from Treasury strategies or Whitehall missions trying to “direct” the economy.

Social engineers, no matter how well-intentioned or educated, cannot “direct” an economy toward growth for a simple reason. If they truly knew which sectors and technologies would define the future, they would be as wealthy as the mansion owners they’re so eager to tax. They don’t know - and it isn’t naivety. Nobody knows. That is the fundamental problem of knowledge. This is not a critique of their intelligence. It is an acknowledgement of our shared, inescapable ignorance. No individual or committee can hold the vast, decentralised, constantly changing knowledge embedded in the market.

This is why markets matter. They provide the institutional framework for trial and error, where people risk their own money, learn from their own mistakes, and enjoy the fruits of their own success. The state cannot be entrepreneurial despite Mariana Mazzucato’s romanticisation of government-led innovation, because bureaucracies lack the mechanisms of discovery. There is no price system, no competition, no profit and loss, and no personal stake in outcomes. Without these, risk-taking becomes political rather than economic, and innovation suffocates under caution and procedure.

Which brings us to the real choice facing Britain. The country needs austerity, but a very different kind from the one Labour is pursuing. What we need is austerity with a supply-side character: serious fiscal consolidation paired with sweeping reforms to unleash growth. Spending cuts alone achieve nothing if they are not accompanied by policies that free the economy. Deregulation is the closest thing to “free money” available to any government: it has virtually no economic cost, minimal political risk, and enormous potential upside. Yet ministers resist it, constrained by backbenchers and ideological reflexes. The proposed mansion tax is an emblem of this problem: a symbolic gesture that punishes success while generating little revenue and sending the worst possible signal to the world’s entrepreneurs.

Austerity is not a moral end. Done correctly, it is a tool for achieving higher growth, lower deficits, reduced inflation, and improving living standards. But the government’s model does none of this. It is merely a holding pattern—a way to survive one more fiscal year without confronting structural weaknesses.

Effective austerity requires reducing the state’s responsibilities, not just its spending. Because of that, Britain needs an intellectual shift. Citizens must stop viewing the state as the answer to every problem and start recognising how often it is the obstacle. The modern state has become a vast mechanism of redistribution among competing interest groups. That is why wealth taxes poll so well: they promise a gain for one group at the expense of another. But as Bastiat warned long ago,

The state is the great fictitious entity by which everyone seeks to live at the expense of everyone else.

Mani Basharzad is an economic journalist. He is currently at the Institute of Economic Affairs, an Asia Freedom Fellow at King’s College, and a regular columnist for CapX. His work has appeared in MoneyWeek magazine, among other publications.

John Maynard Keynes (1982). “Activities 1931-1939: world crises and policies in Britain and America”

Measuring GDP can be missleading. The costs of HS2 added to GDP despite it resulted in nothing usefull. Also when they were less efficient GDP grew more. GDP measures what we spend rather than what value is added.