Sound money for the 21st Century

I am a sound money maximalist: look to gold and Bitcoin. Gold has been made simple. Here's how to navigate cryptocurrency, that is, emerging synthetic commodity money: it's Bitcoin.

This article is for informational purposes only. It does not constitute investment advice, and nothing herein should be construed as a recommendation to buy, sell or hold any financial instrument, including cryptocurrencies or gold. Readers should conduct their own due diligence and consult a regulated financial adviser if in doubt.

Sound money in the 21st Century means gold and Bitcoin1. Gold is easy to understand but how do you navigate the bewildering territory of cryptocurrency?

Sound money is the cornerstone of a free society

During my 20s, serving as an engineer officer in the Royal Air Force, I took the institution of money for granted. Having left for the opportunity of the Dot-Com boom, I was reading for an MSc in Computation (computer science) at Oxford in 1999-2000, when the Dot-Com bubble burst.

I long wanted to see gold reinserted into the payments system: anyone should be enabled to buy, save, send and spend physical gold with the convenience of a debit card. That is what Glint has delivered: download their app, register and your Glint Mastercard will follow. Once you have funded your account, you can buy your own physical gold, allocated to you and secured in an insured vault – and spend it everywhere Mastercard is accepted. It is a revolution. Learn more via glintpay.com.

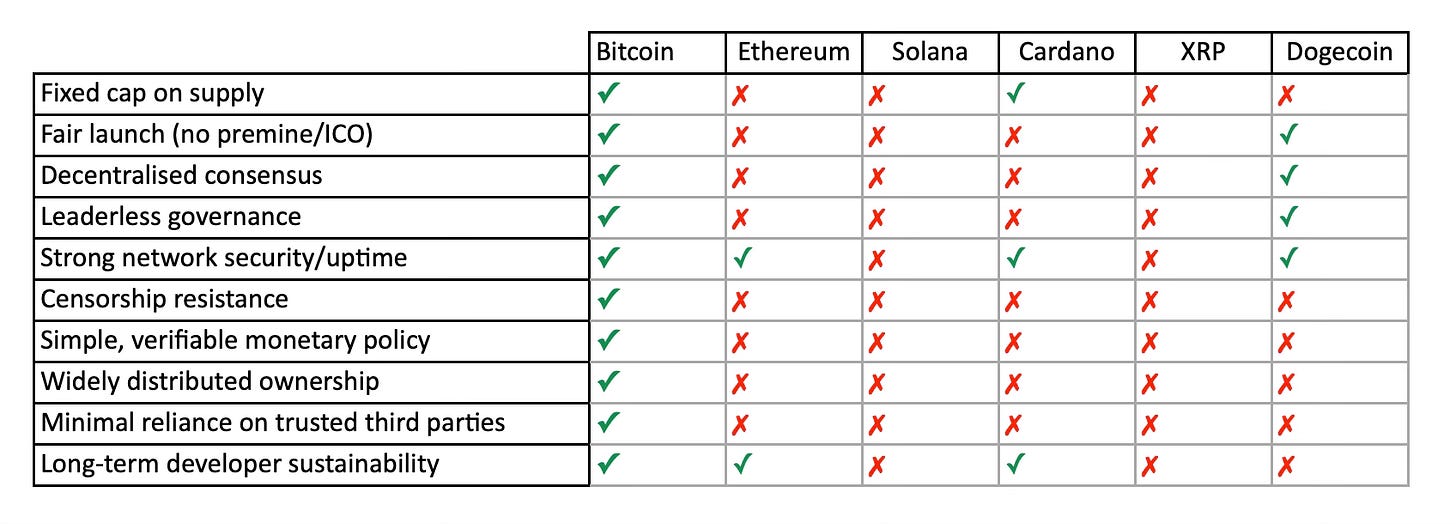

But cryptocurrency is much harder to understand. What are the relative merits of Bitcoin, Ethereum, Solana, Cardano, Ripple and Dogecoin?

The short answer is this: there is Bitcoin and there is “shitcoin”, a pejorative term for alternatives. This is “Bitcoin maximalism”: the view that every other cryptocurrency is fundamentally flawed. Indeed, Bitcoin maximalists often insist that Bitcoin is separate from cryptocurrency. Why?

I had ChatGPT research do the heavy lifting. Here’s a summary, judging the key cryptocurrencies against the standards of Bitcoin2 (ICO - “initial coin offering”):

The case is made in the following paper generated using ChatGPT research3:

Bitcoin advocates (often dubbed Bitcoin maximalists) are famously skeptical of alternative cryptocurrencies (often derisively called “shitcoins”). In their view, Bitcoin is unique as the only truly decentralized, sound digital money – and most other coins are inferior imitations or outright scams.

They argue that many altcoins violate core principles of cryptocurrency in various ways: economically (by having inflationary or opaque supply and unfair token distributions), technically (via centralized control or vulnerable designs), philosophically (failing to uphold decentralization or sound monetary ethics), and culturally (engendering hype, scams, and misplaced trust in leaders). Below is an overview of prominent altcoins and the main criticisms leveled against them by notable Bitcoiners, organized by these perspectives. Throughout, Bitcoin proponents’ direct words are cited to illustrate their stance.

I do not endorse Bitcoin because it is fashionable, nor gold because it is traditional. I advocate for both because they meet the standard that matters most: they protect the individual from arbitrary power. They allow us to save without stealthy confiscation through inflation. Both provide sound money for the 21st century, even given Bitcoin’s volatility as it emerges as a synthetic commodity money.

By contrast, much of what is now marketed as “crypto” amounts to a rebranding of the very monetary abuses Bitcoin was designed to displace: insiders minting tokens, enriching themselves through opacity and inviting retail investors into financial systems based on trust rather than truth. A strong avoid. Some will make money speculatively trading altcoins: many more will lose fortunes.

That is why I distinguish Bitcoin – and gold – from the rest. I do not believe in magic internet money. I believe in sound money, proven and principled. And I believe our future depends on it.

Readers who disagree are most welcome to make their case in the comments!

This is a free post.

I’ve already posted my views on Glint (all positive) the only thing I’d add is that anyone looking for gold and Bitcoin exposure should look at Charlie Morris’ BOLD ( Bitcoin and Gold fund) which has doubled in just over 2 years.