The Laffer Curve Trap: The Missing Moral Arguments in Tax Policy

The free-market right is at risk of conceding the moral legitimacy of taxation. We must endeavour to put morality back at the head of debates around tax policy.

Taxes in the United Kingdom are too high. I imagine everyone reading this article will recognise that to be an inalienable fact.

But when advocating for lower taxation - a position that ought to flow naturally from principles of individual liberty and limited government - an important moral dimension is often missing.

Commentators have increasingly abandoned moral arguments against taxation in favour of purely economic justifications. This is most clearly exemplified in the contemporary right’s enthusiasm for the Laffer Curve, developed by economist Arthur Laffer in the 1970s.

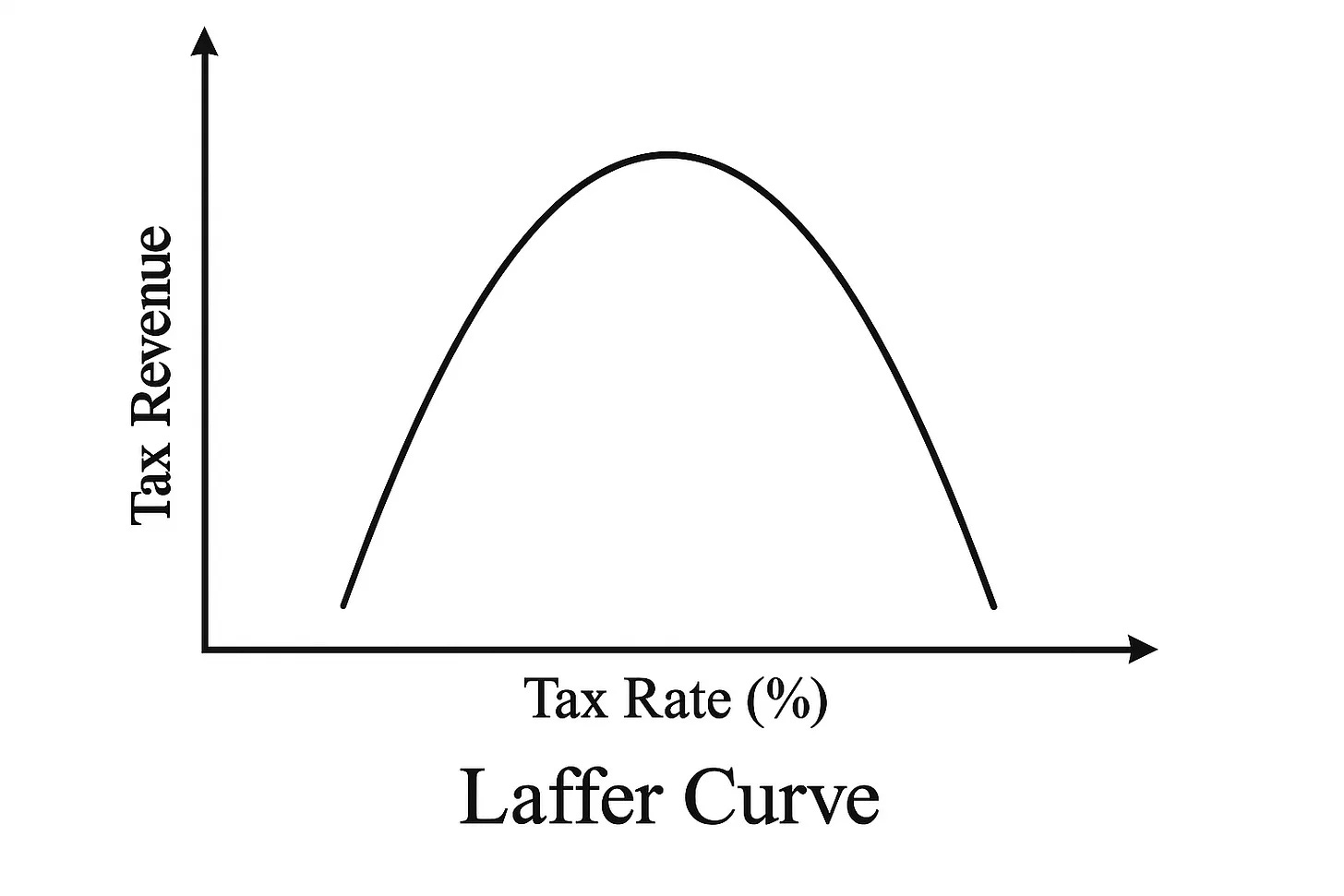

This diagram illustrates the relationship between tax rates and tax revenue, demonstrating that at both 0% and 100% tax rates, governments collect no revenue - either because there's no tax or because people have no incentive to work. The curve suggests there exists an optimal tax rate that maximises government revenue, beyond which higher rates become counterproductive and actually reduce total collections.

You can read more about the Laffer Curve and its practical applications here:

While such economic analysis has its place, we mustn’t lose sight of the moral high ground which free-marketeers once confidently occupied. The contemporary right's enthusiasm for Laffer Curve-type arguments arguably creates what might be called an "intellectual trap”: by arguing that tax cuts will generate more revenue for the state, conservatives implicitly concede that maximising government income is an appropriate measure of good tax policy.

This turns traditional classical liberal concerns about limited government on their head, making state financing the primary consideration rather than individual liberty or the proper scope of governmental power. Most problematically, this framework implies that taxation requires no moral justification beyond its practical effects.

In this view, the burden of proof falls on those who would reduce taxes rather than on those who would impose them. Some free-marketeers thus find themselves arguing that the state deserves more revenue from lesser rates, rather than questioning whether it deserves any particular claim on individual earnings in the first place.

Remembering the Missing Moral Dimension

This economic analysis represents a dramatic departure from the philosophical foundations that once underpinned free-market thought about taxation and property rights. Locke and Nozick offer two compelling moral anchors to demonstrate this.