The Catastrophic Consequences of our Government Spending Laid Bare

Once again, “catastrophic collapse” were the words of the day.

Where were you when you first realised that our public finances were on course to a catastrophic collapse?

For too many, the answer might have been somewhere yesterday. Sitting in a Costa, reading the Office for Budget Responsibility’s Fiscal Risks and Sustainability Report, the weight of our financial woes was once again pressed on to me too.

It was heartening to see the message that our public spending is in a dangerous state picked up across mainstream media - even by the BBC, no less.1

But they needn’t have been surprised. For years, the Rt Hon Steve Baker has been arguing that our unaffordable spending commitments and our unproductive economy, fuelled by cheap credit and QE, can only be explosively disastrous.

The OBR’s Fiscal Risks Report 2025

There’s no two ways about it: the report makes for grim reading. Here are three key takeaways from the report, but I would say it’s worth looking at it in full.2

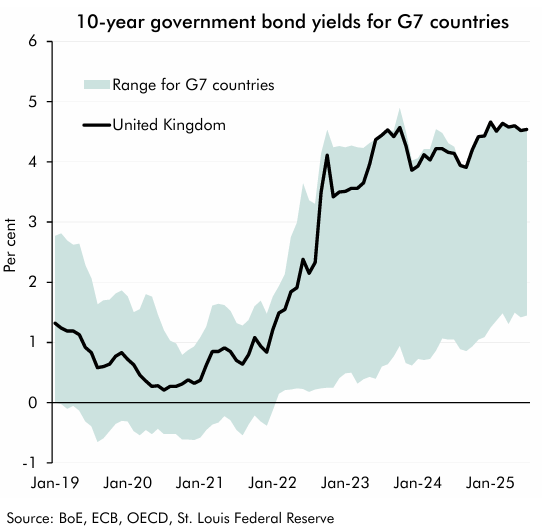

We are no longer trusted to spend responsibly

The UK’s cost of borrowing is now consistently at the top of the range of G7 economies. As Julian Jessop argues, our public debt is now among the highest in the same category, so this reflects a lack of fiscal credibility.3

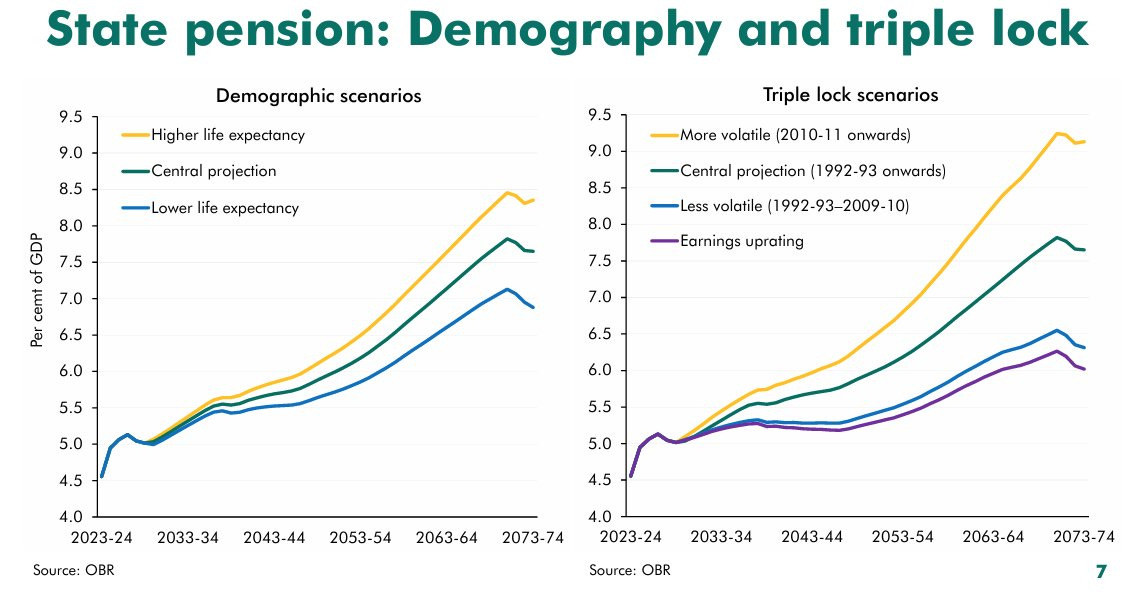

Our Pensions system is out of control

The OBR spends much time analysing the costs of the Triple Lock, using that term no less than 63 times in the report.

It illustrates that demographic shifts mean the policy is now estimated to cost £15.5 billion by 2029-30, about three times more than initial projections.

The OBR argues that this poses a key risk to our public finances, and they are right; a sentiment which is compounded by various other studies. In 2022, the Government’s Actuary’s Department illustrated in their review of the National Insurance fund that, on our current trajectory, the UK will effectively default on our welfare spending commitments in 2043-44 when the fund reaches zero.5

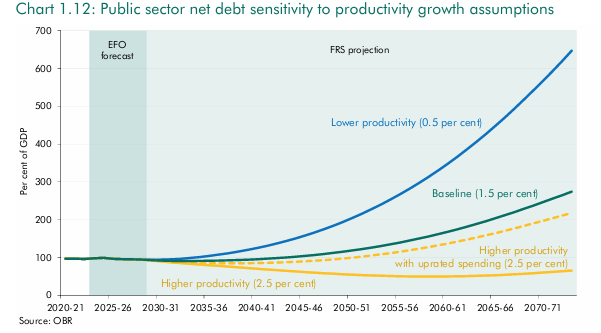

Without a boost to productivity across the entire economy, debt will continue to balloon

While not much has changed since last year’s OBR report, the warning is still prescient: if long-term productivity growth is just 0.5% a year, debt will reach an astonishing 647% of GDP by 2073-74.

So, what must be done?

When it comes to addressing the financing of our entitlement commitments, we don’t have a New York minute to spare.

This is not a problem of party politics. We are not in this situation by the fault of one administration or another, but rather more than a century of path-dependent, expansionary decision making dating back at least to the 1911 National Insurance Act.

As my colleague Harry Richer put so brilliantly a few weeks ago, the problem is spending.

The favourite strategy of successive administrations - fiddling around the edges of our bloated entitlements system until it looks just slightly like there’s some improvement - just won’t do it. The other favourite strategy, increasing taxes, won’t either, seeing as we are now surely well past the UK’s productive capacity to be taxed.6

But the consequences of doing nothing do not bear thinking about. Without bold reform or a turnaround in growth, the UK’s welfare promises are on a collision course with fiscal reality: a default on all state pensions. The potential political and social consequences are truly terrifying.

We must radically shrink the state, reform the monetary system, drastically boost productivity across the entire economy, end limits to growth, and get us all back on the path to prosperity.

Most urgently, we must review our system of welfare commitments which would surely allow the state to promise more and more benefits, well beyond the point of initial collapse.

The sooner our politicians realise the gravity of the situation and put the country back on the path to prosperity, the sooner we will avoid a default on the pensions system in our lifetime. The consequences of such a thing are unimaginable, but the threat of default is real, credible, and significantly closer than we might like.

For most people, reading 152 pages of economic analysis would feel like a true nightmare. Yesterday, the policy nerds who usually enjoy it might finally agree.

Liam Noble Shearer is the Operation’s Manager at Fighting for a Free Future. A graduate of the University of St Andrews and King’s College London, Liam previously spent two years working as a Parliamentary Aide to Rt Hon Steve Baker.

https://www.bbc.co.uk/news/articles/cy7nv3pdgr4o

https://obr.uk/frs/fiscal-risks-and-sustainability-july-2025/

https://x.com/julianhjessop/status/1942532762650460550?s=46

All graphs included are from the Office for Budget Responsibility’s Fiscal Risks and Sustainability Report, 2025.

https://www.gov.uk/government/publications/government-actuarys-quinquennial-review-of-the-national-insurance-fund-as-at-april-2020

https://www.politeia.co.uk/the-uks-taxable-capacity-has-britain-already-reached-the-upper-limit-by-david-b-smith/

Great piece Steve. Your efforts to inform the public are important.

As a practitioner of financial markets for many years I know well how policy makers have compounded their mistakes over a long period.

In recent times one can see the moral hazard created from LTCM in 1994 onwards and the Brown revolution that pervades to this day in the Treasury. Then the accession of China to the WTO meaning globalisation has had little to do with free markets.

One of the things I worry about is a recent trend where I start to see commentators blaming free markets and neoliberalism for these problems?

They see the crisis coming and those that would seize the opportunity to impose yet more state on us (typical in crises), will lay the blame everywhere but at their door.

What we see is not the failure of liberal capitalism but the success of state sponsored corporatism.

As I like to say….I no longer see the invisible hand.

Maggie used to say ‘we all need a Willie’, I think we could adapt that now to ‘we all need a Milei’ where you can see after decades of corrupt Peronism his ‘Afuera’ approach to cutting the State back materially and getting out the way of the markets is yielding real results. Proof points;

Last year the first fiscal surplus in 100 years,

Inflation down from 25% per month to (a still too high) 25% per year,

Last month the first recorded deflation in decades making the people’s wages go further,and

Enviable levels of GDP growth which the UK would kill for.

Just think from decades long basket case to economic poster child in 18 months - if that doesn’t prove the case for sound money, small government and balanced budgets I don’t know what will.